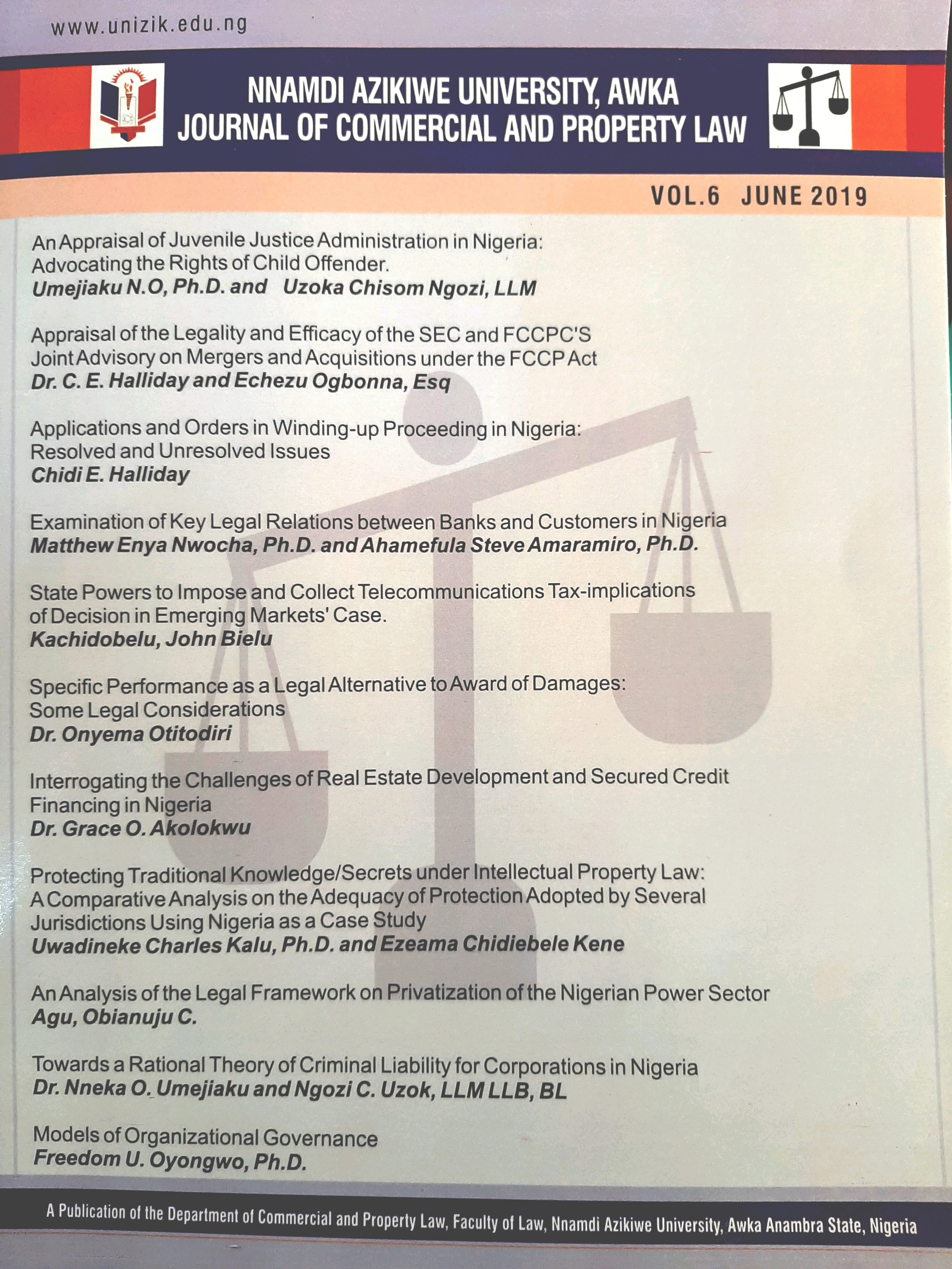

STATE POWERS TO IMPOSE AND COLLECT TELECOMMUNICATIONS TAX-IMPLICATIONS OF THE DECISION IN EMERGING MARKETS v ANAMBRA STATE RUTSU CASE

Abstract

The Constitution distributed the taxing powers to the federal, state and local governments in Nigeria. In the distribution, it does appear that the constitution has not done much to improve the plight or lot of the states in terms of allocation of financial sovereignty with the attendant consequences that federal and state governments have remained in opposition. This latent war between the federal government and the state governments on which of the two has power to impose tax particularly on telecommunications has continued to rage. The constitution provided for tax on telecommunication and where any law is made that is inconsistent with the provisions of the Constitution of the Federal Republic of Nigeria 1999 as amended same is null and void. This essay will appraise relevant provisions of the Constitution of the Federal Republic of Nigeria, 1999 as amended, statutes and case laws with particular reference to the decision in Emerging Markets Telecommunication Services Ltd v Anambra State Rural and Urban Transmission Supervisory Unit & 3 Ors to determine the government that has the powers to impose the telecommunications tax.