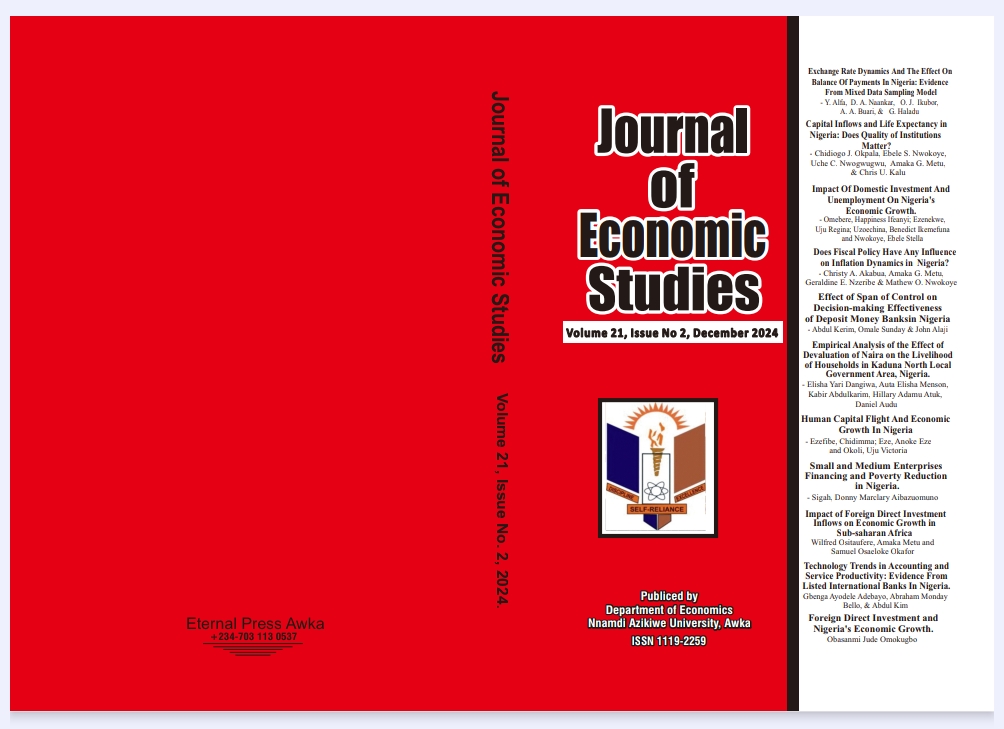

SMALL AND MEDIUM ENTERPRISES FINANCING AND POVERTY REDUCTION IN NIGERIA

Keywords:

Economic development, poverty reduction, private sector credits, Nigeria, SME financing,Abstract

This study examined how small and medium enterprises (SMEs) financing affects poverty reduction in Nigeria. This followed the understanding that SMEs play a critical role in the process of economic development. The datasets obtained from the CBN Statistical Bulletin and World Bank were analysed using the error correction model (ECM) Technique. The parsimonious ECM result showed that bank credit to SMEs significantly reduced poverty during the study period. This finding highlights the critical role played by SME financing in promoting economic development in Nigeria. The results further showed that private sector credit affected poverty headcount negatively indicating that the availability of credit to the private sector has not contributed to poverty reduction in Nigeria. On the contrary, the result also showed that interest rate contributed positively to poverty in Nigeria. This finding could be attributed to the continuous increase in interest rates which limits investments in critical sectors of the economy that have the potential for poverty reduction. Owing to the findings, this study concludes that SME financing provides a sustainable road map for poverty reduction in Nigeria. Hence, it is recommended that the Central Bank of Nigeria and deposit money banks should prioritize SME financing to create more opportunities for sustainable poverty reduction strategies.